How a systematic transfer plan helps you to deal with volatility

- internship04

- Sep 24, 2025

- 2 min read

Systematic Transfer Plan (STP)

What is a Systematic Transfer Plan (STP)?

A Systematic Transfer Plan (STP) is an investment strategy that allows you to move money from one mutual fund to another at regular intervals, helping you manage market volatility, optimize returns, and maintain a balance between risk and reward. Instead of investing a lump sum directly into an equity fund, you invest it in a relatively safer fund-like a liquid or ultra-short-term fund (the "source scheme")-and then systematically transfer a fixed amount or percentage into your chosen equity or growth-oriented fund (the "destination scheme").

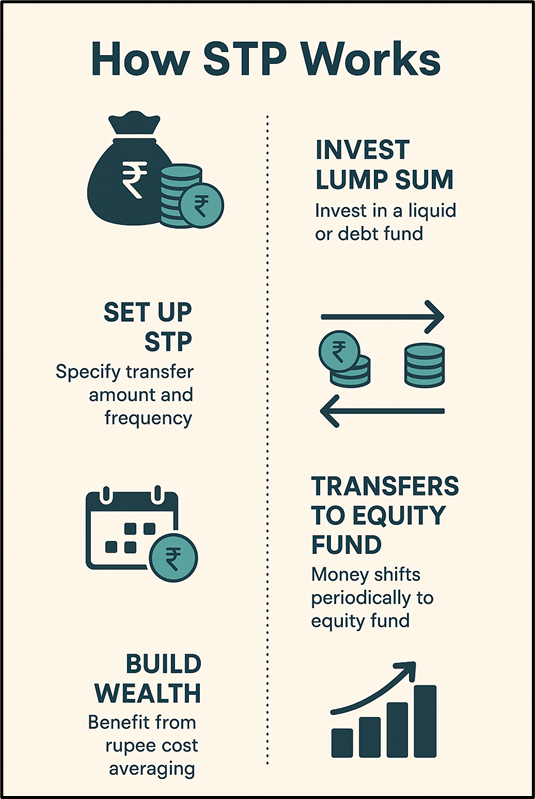

How Does an STP Work?

Initial Investment: Start by investing a lump sum in a low-risk mutual fund (typically a liquid or debt fund).

Set Transfer Details: Decide the amount or percentage and the frequency (e.g., monthly or quarterly) for transfers to your target fund (usually an equity fund).

Automatic Transfers: The mutual fund provider automatically moves the specified amount at each interval, reducing manual effort and the temptation to time the market.

Portfolio Balance: Over time, your money shifts from the safer fund to the higher-growth fund, balancing risk and return.

Types of Systematic Transfer Plans

STP Type | Description | Best For |

Fixed Amount STP | Transfers a set amount at regular intervals (e.g., ₹5,000/month) | Predictable, disciplined investing |

Fixed Percentage STP | Transfers a fixed percentage of the source fund at each interval | Dynamic, adjusts with fund growth |

Capital Appreciation STP | Transfers only the gains (appreciation) from the source fund | Locking in profits, minimizing risk |

Key Benefits of Using an STP

● Manages Market Volatility: Gradual investment helps avoid investing a lump sum during market highs or lows, reducing risk.

● Disciplined Investing: Regular, automatic transfers encourage consistent investment habits.

● Cost Averaging: By investing at different market levels, you buy more units when prices are low and fewer when prices are high, averaging your purchase cost.

● Flexibility: Adjust the amount, frequency, or even the target fund as your goals change.

● Better Returns than Savings: Money parked in a liquid fund often earns higher returns than a regular savings account while waiting to be transferred.

● Portfolio Rebalancing: STPs can be used to rebalance your portfolio between debt and equity based on your risk profile and market conditions.

How to Start an STP

Choose Your Source Fund: Typically a liquid or ultra-short-term fund from the same asset management company as your target fund.

Decide Transfer Details: Set the amount/percentage and frequency.

Select the Destination Fund: Usually an equity or balanced fund aligned with your risk and return goals.

Initiate the Plan: Most mutual fund platforms allow you to set up an STP online or through your advisor.

Comments