ELSS

- internship04

- Sep 22, 2025

- 2 min read

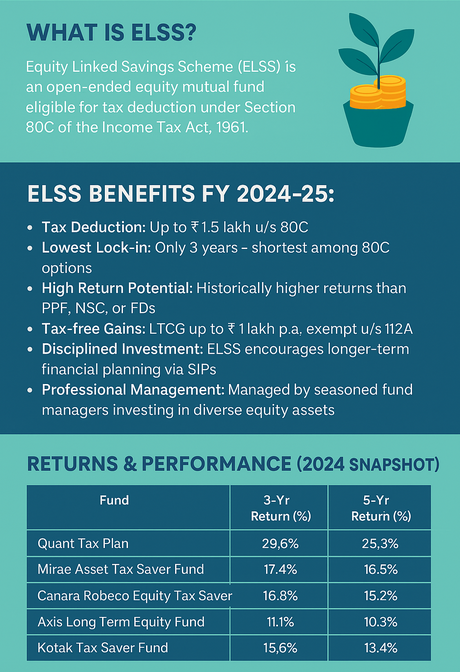

What is ELSS?

Equity Linked Savings Scheme (ELSS) is a type of open-ended equity mutual fund eligible for tax deductions under Section 80C of the Income Tax Act, 1961. These funds invest at least 80% of their corpus in equity and equity-related instruments. The amount invested (up to ₹1.5 lakh annually) is eligible for tax deduction, reducing your taxable income.

Benefits:

· Tax deductions: up to 1.5 lakh under section 80C

· Lowest lock in period of only 3 years

· Very high return potential as most of the money will be invested in equity

· Tax free gains: gain up to 1 lakh a year is tax free.

· Disciplined investment: ELSS encourages long term financial planning via SIPs

· Professional management is done by seasoned fund managers who invest in diverse assets.

Lock-in period:

As compared to the PPF (15 years) or the NSC (5 years), ELSS has a lock-in period of only 3 years, making it more liquid than the rest. Though one cannot redeem the investments before 3 years, the short tenure offered by ELSS is ideal for the medium term.

Returns - A snapshot!

FUND | 3 YEAR RETURN | 5 YEAR RETURN |

Quant Tax Plan | 29.6% | 23.3% |

Mirae Asset Tax Saver Fund | 17.4% | 16.5% |

Canara Robeco Equity Tax Saver | 16.8% | 15.2% |

Axis Long Term Equity Fund | 11.1% | 10.3% |

Kotak Tax Saver Fund | 15.6% | 13.4% |

Tax treatment:

· Capital gains tax: LTCG up to 1 lakh a year is tax free. Above 1 lakh is taxable at 10% and there is no indexation

· Dividends is taxed as per the income slab post the finance act of 2020

Who is it suitable to?

· People who can wait 3 years

· Young professionals who are beginning to plan on tax

· Salaried employees seeking better post tax returns

· Investors looking to transition from traditional instruments like the FDs, or PPF to equity

Comments